Teachers on PolyTripper are considered independent contractors and not employees. PolyTripper provides online teachers with tools to effectively teach online. We provide teachers a directory listing and payment processing through third-party processing services. The function of PolyTripper is a technology services provider. Teachers are independent contractors that use our services.

Since you are not an employee of PolyTripper, but an independent contactor that uses the services provided by PolyTripper, we do not provide you with any tax forms, like the 1099 form for instance. (For United States tax residents, PayPal or Payoneer would be the 1099 providers, for example.) You are responsible for handling your own tax obligations. It can be helpful for you to get advice from tax professionals or accountants who specialize in tax matters for independent contractors. These people can help you understand what your tax obligations are and what potential deductions you can claim. When you report your taxes, you may need to file them as a self-employed individual or sole proprietor, depending on your specific circumstances.

As an independent contractor, you may qualify for tax deductions related to your online teaching. These deductions could include expenses for teaching materials, your internet connection, and potential home office expenses. Consult a tax professional to determine eligible deductions based on your situation and location.

Consider reaching out to the payment provider (e.g., PayPal or Payoneer) through which you receive earnings on PolyTripper. They often provide transaction history and financial statements for tax reporting.

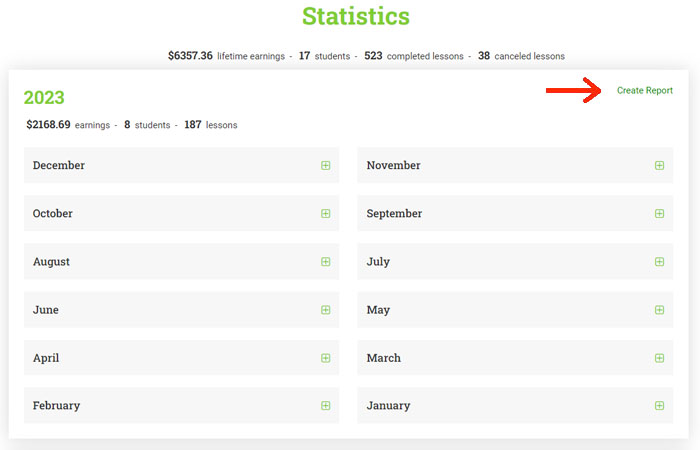

For each year you work on PolyTripper, we give you a report of your earnings. You can find this report by going to your Statistics page and by clicking on the link. This report helps you to keep track of your earnings, which can make reporting taxes easier.

We strongly advice you to keep detailed records, including receipts and invoices, of all your income and expenses related to your teaching services. This will greatly help you with accurate tax reporting.

Please check what your exact tax obligations are in your country of residence and whether there are any applicable international tax treaties or agreements. Laws and regulations can vary significantly by country, so please seek advice about your individual circumstances.

The information in this FAQ is for informational purposes only and not tax advice. Consult tax professionals for personalized guidance.